Short Courses

Renewable Energy Series (CPD Short Courses)

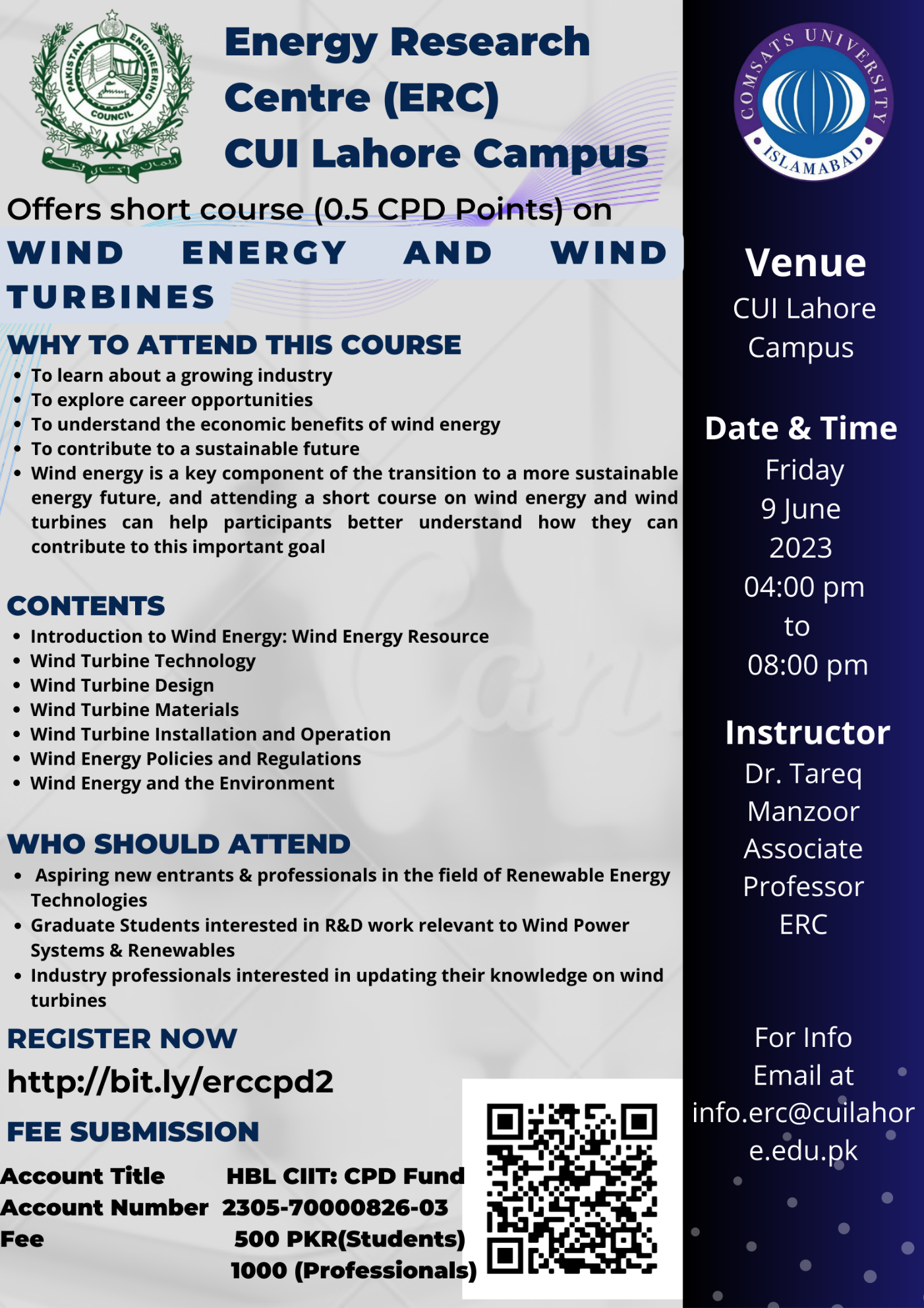

For Registration of “Wind Energy and Wind Turbines” Course Click Below (Last date of Registration and Fee Submission 7 June 2023).(Last date of Registration and Fee Submission June 07, 2023).

Click Here For Registration

In case of any query Please Email info.erc@cuilahore.edu.pk

Renewable Energy Series (CPD Short Courses)

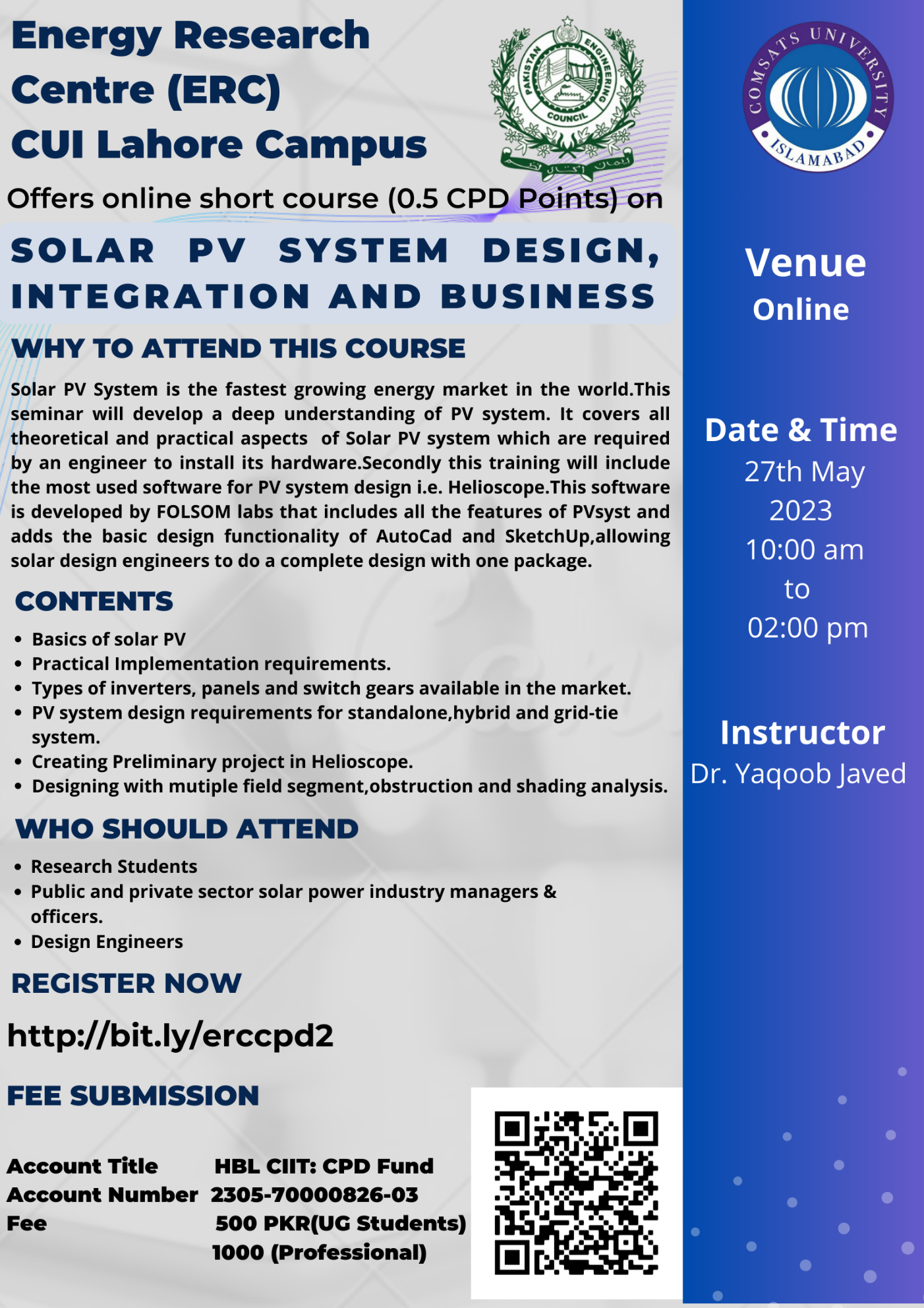

Solar PV System Design, Integration and Business (Online Course) 0.5 CPD

For Registration of “Solar PV System Design, Integration and Business” Course Click Below (Last date of Registration and Fee Submission 26 May 2023).

Click Here For Registration

In case of any query Please Email info.erc@cuilahore.edu.pk

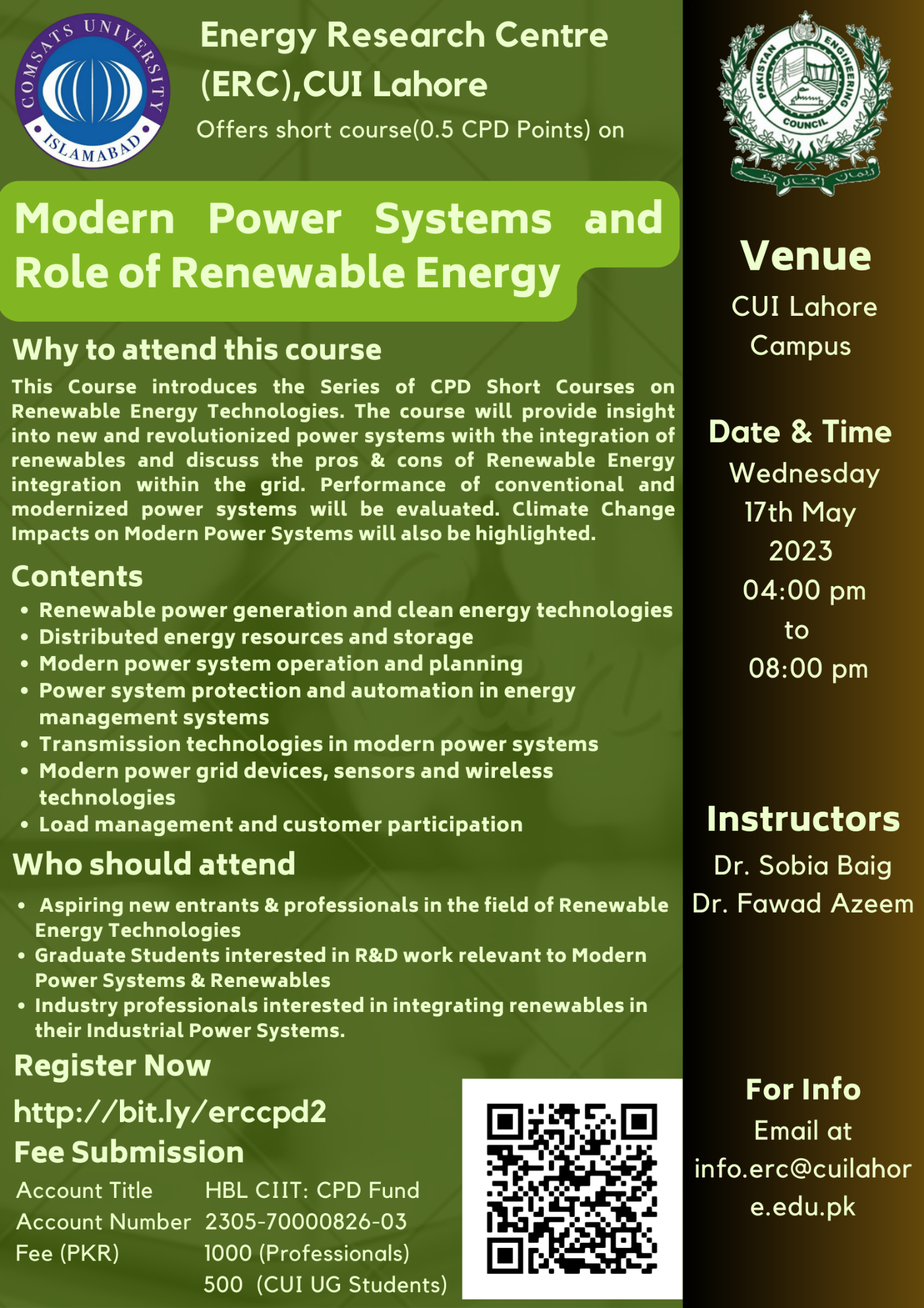

Modern Power Systems and Role of Renewable Energy

For Registration of “Modern Power Systems and Role of Renewable Energy” Course Click Below (Last date of Registration and Fee Submission 15 May 2023).

Click Here For Registration

In case of any query Please Email info.erc@cuilahore.edu.pk